| 「電子發票」是什麼? 導入電子發票的效益 電子發票導入效益比較 企業為什麼要開電子發票? 一定要找加值中心嗎? |

電子發票

指利用網際網路或其他電子方式,開立、傳輸或接收的統一發票。它包含雲端發票及電子發票證明聯。

雲端發票

不印出紙本的電子發票,需透過各種載具儲存於雲端,或是透過捐贈碼將發票捐給受贈機關(團體)。

電子發票證明聯

印出紙本的電子發票,紙張會有「電子發票證明聯」字樣,可以憑以兌獎。

導入前後的差異

| 開立接收 | 帳務處理 | 配合政府機關 查帳報稅 | 整體評估 | |

|---|---|---|---|---|

| 導入前 | 開立紙本 郵局寄送 遺漏風險 | 人工撰寫 寄送郵資 倉儲成本 | 紙本憑證 管理繁瑣 | 耗時費力 成本較高 |

| 導入後 | 電子交易 立刻完成 | 電腦處理 數位儲存 省錢省力 | 電子資料 直接匯入 查對快速 | 簡化流程 經濟效率 |

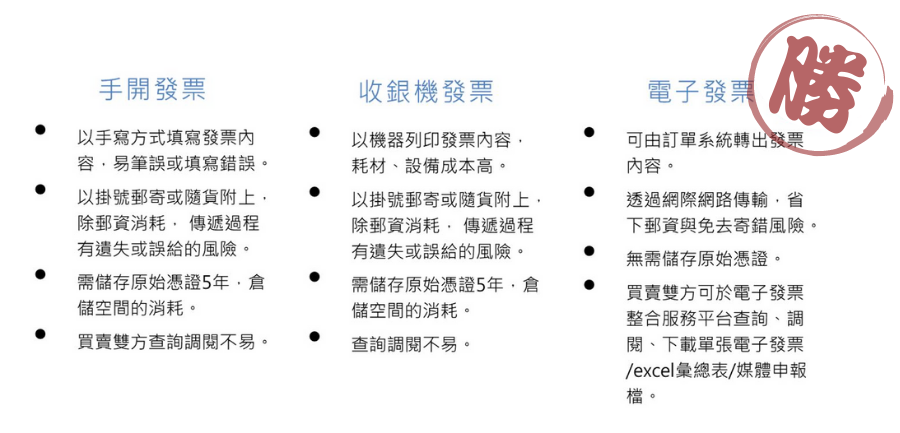

發票類型比較

郵資比較

| 發票類別 | 單位 | 單價 | 每單位張數 | 每張成本 | 寄送20張的郵資(掛號) |

|---|---|---|---|---|---|

| 二聯式手開發票 | 本 | 16 | 50 | 0.32 | 560 |

| 三聯式手開發票 | 本 | 19 | 50 | 0.38 | 560 |

| 收銀機發票 | 捲 | 78 | 250 | 0.312 | 560 |

電子發票~無紙化 ~網路傳輸零成本

每月發票本、郵資......馬上省下

統一發票電子化是政府政策的既定方向,電子發票除了在資料的儲存、保留、運用、查找上比傳統紙本發票要簡便經濟,對減少紙張使用以及降低企業營運的時間和人力成本,也有很大的助益。

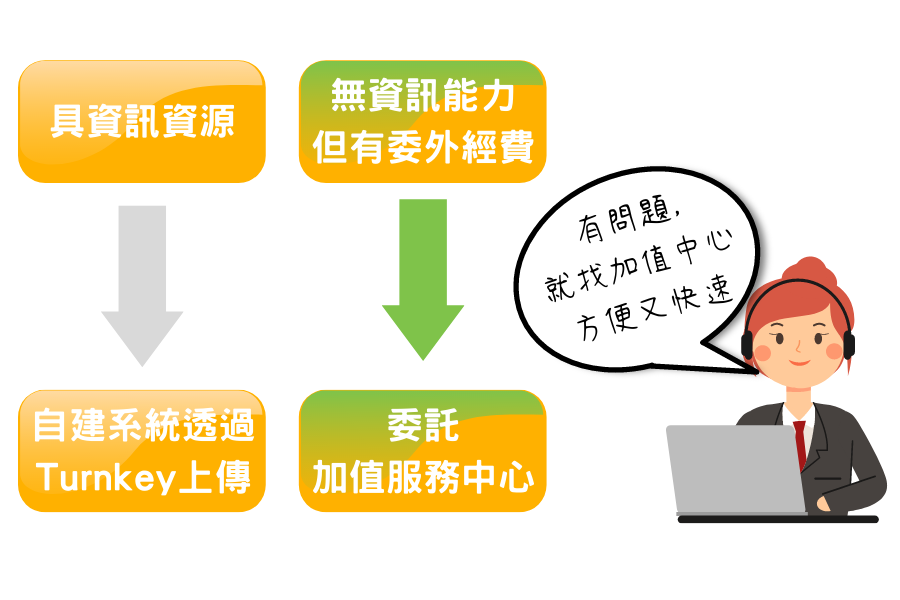

有兩種方式:

1. 自己做-需要有資訊資源,自建Turnkey並需有維護能力。

2. 委託加值中心,簡便、快速。

.png)